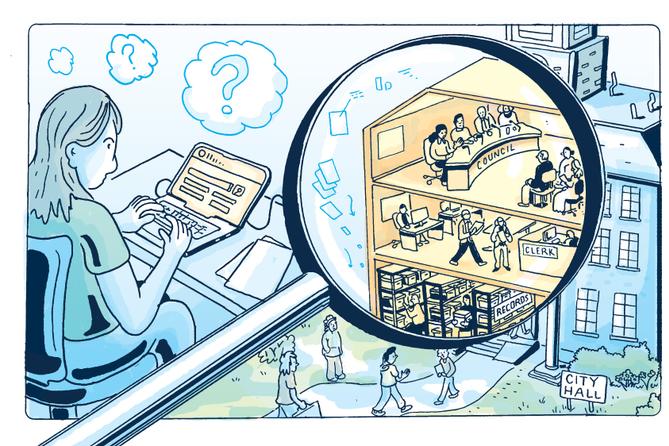

How Local Government Works is a series that focuses on issues and trends in Pennsylvania local governments and provides tools for readers to hold their local officials accountable.

STATE COLLEGE — Last summer, officials in a small Centre County township revealed that more than half a million public dollars appeared to be missing. State Police eventually charged the township’s now-former secretary and treasurer for the alleged theft, laying out an alleged five-year scheme that ballooned from a few small purchases into a slush fund for sports betting.

Gregg Township faced difficult questions about how such a large sum of taxpayer funds went unaccounted for so long, including by auditors who annually examine the township’s financial picture.

Most municipalities in Pennsylvania must submit an audit and financial report to the state every year. But these audits are not meant to catch fraud, experts say.

Rather, a forensic audit would identify such a serious issue. But because there is no requirement to conduct such audits, and they can be costly, Pennsylvania local governments generally do not perform them unless there is suspicion of impropriety.

“I think there’s a huge misconception between what an audit is versus what a forensic audit is,” forensic fraud examiner Scott Koman told Spotlight PA in a December interview.

Pennsylvania boroughs, townships, cities, and home-rule municipalities must file basic, internal tallies of their money with the Department of Community and Economic Development annually. Counties and school districts are required to submit in-depth annual audits completed by independent certified public accountants.

“DCED relies on this data to help determine the financial health of a municipality, and that data is provided to the public,” a spokesperson for the department told Spotlight PA in an email.

While the agency does not audit those records, it reviews balance sheets, tax revenues allocated to local governments by the state, and appropriate signatures, the spokesperson wrote.

“If the DCED is notified that data is inaccurate, we take the necessary steps to confirm, and if true, request they amend the report,” but the spokesperson could not provide an example of this. Additionally, the agency can limit municipalities from receiving coveted funds it administers, such as community block grants, for noncompliance.

An internal audit typically includes information about a local government’s assets, liabilities, revenue, and expenditures. Generally, an elected auditor or controller completes the report. They aren’t required to have a professional background in finance.

“That audit is generally just a standard to make sure that they are accounting for things properly, especially when dealing with public funds,” Ben Kafferlin, a partner at the consulting firm Kafferlin Strategies, told Spotlight PA. That kind of internal assessment might be all a smaller municipality needs to keep its finances in check, he said.

But for larger municipal governments, especially ones that receive multiple state and federal grants, “a full-blown external audit” by professional accountants is indispensable, said Kafferlin, a former Warren County commissioner.

An in-depth third-party audit would look at not only crucial financial files — accounts payable and receivable, invoices, the general ledger, and past audits — but also meeting minutes, contracts, and records that document decisions about how public dollars are spent, said Lisa Hagberg, also a partner at Kafferlin Strategies.

“They’re going to look at internal controls and how we manage who does what,” Hagberg, who worked in government finance for nearly three decades, told Spotlight PA. “It’s our job as managers to make sure that we aren’t putting our people in a position for fraud, and the auditors help in that by making sure that we’re following good internal controls for how the money flows.”

While a routine audit can identify fraud, that is not its primary intent, said Koman. “The auditor, in performing their audit and preparing their audited financial statements, will disclose that the purpose of their audit is not to detect fraud,” he said.

A forensic audit, on the other hand, investigates whether fraud, negligence, or noncompliance with rules has occurred. It also can determine how fraud was perpetrated after an incident is uncovered, Koman said.

Most local governments don’t need a forensic audit, Kafferlin said. He added that external audits still offer an independent look at the state of finances.

Any significant problem — often called a material weakness — identified in an external audit must be fixed, Kafferlin said. Additionally, professional auditors would offer general recommendations. “You’ll take all these recommendations, sift through them, see what is and is not actionable, what you can and can’t afford, and … give the tasks to people that make the most sense,” he said.

Kafferlin said he expects more local governments to rely on professional finance management in coming years because the legalese and technology involved are growing more complex.

“Gone are the days of your local secretary-treasurer just being able to handle everything in QuickBooks,” he said.

While audits aren’t meant to catch fraud, financial professionals and government experts recommend certain practices to help prevent it, including separating duties among government staff.

That could mean ensuring the person receiving money is different from the one spending it. Making sure elected leaders review and approve expenses publicly could be another.

In Gregg Township, the alleged fraud was primarily perpetrated using municipal credit cards, with years of statements showing $322,185 in charges to sports betting platform DraftKings.

Township supervisors had never seen them.